- WE’RE HERE TO HELP | SE HABLA ESPAÑOL

- 800.586.5555

Personal Property and Home Content Claim Tips

Personal Property and Home Content Claim Tips

When people think of claim denials or claim underpayments, they’re often thinking of big-ticket home repairs like replacing roofs, garage doors, flooring and windows. What’s less frequently discussed are the many little things that can also be destroyed in hurricanes, home fires, plumbing leaks or other disasters that befall your Florida home.

Hurricanes can wreak havoc on your personal property. Roof leaks that let in water can damage everything from computers and televisions to clothing and furniture. Wind-blown debris that smashes windows can leave rooms open to the elements, resulting in the destruction of everyday items like sheets, mattresses, books and artwork.

Your home – whether it’s a house or an apartment – is full of a lifetime’s worth of possessions. Your homeowners or renters policy should cover the loss of your personal property and pay for its replacement.

Getting fair compensation for these many “little” losses isn’t always easy or straightforward, but there are some things you can do to increase your chances for full claim payment.

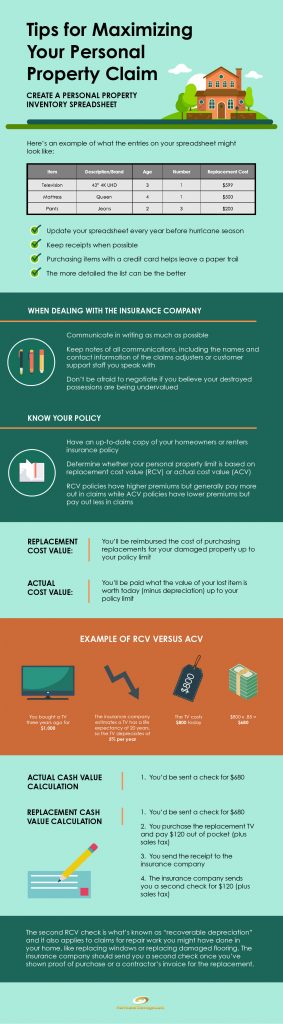

Create a Contents List

Most people don’t keep an up-to-date list of all their possessions just for the peace of mind that’s derived from complete disaster preparedness. When you buy a new TV or laptop your first thought likely isn’t, “Put it on the home content list!”

You may want to get into the habit of changing that – at least within reason. You shouldn’t let fear of damage rule your every waking moment, but setting aside a day each year in the lead up to hurricane season to update your home’s inventory isn’t a bad idea.

Make a list of your big-ticket possessions, from furniture purchases and electronics to expensive clothing and jewelry. Keep the receipts somewhere safe. If you use a credit card to make purchases, then you probably already have a record of the items in your home.

Insurance companies aren’t just going to take your word for everything, which is one of the reasons you shouldn’t immediately toss damaged belongings after a hurricane. At the very least you should take pictures of the damaged property before you throw it away, so you have proof for your claim.

Understanding Depreciation, Replacement Cost and Cash Value

There are three important insurance concepts that will influence the amount of money you’ll be able to get for belongings that are damaged in a hurricane or any type of home disaster. The insurance company will calculate your personal property claim payment based on either the items’ replacement costs or actual costs.

Depreciation applies to everything from business equipment to cars and electronics. Everything has a life expectancy. If you lose an item at the end of its useful life the insurance company won’t want to pay you the full purchase price. They’ll determine what the item is worth based on its current valuation and the years of usefulness it had left.

You can find some depreciation calculators online that will let you estimate the actual value of a variety of home appliances and personal possessions.

Replacement cost value (RCV) is how much it would cost to purchase a replacement for the item lost. You might have bought a TV for $1,000 five years ago but maybe now you could get a comparable TV for $500. The insurance company would pay you the replacement cost not the purchase price. They may also send you a second check for “recoverable depreciation” once you show them how much you had to pay out of pocket for a replacement.

The actual cash value (ACV) is essentially the value of an item that’s been depreciated. You can figure out the actual cash value of an item by determining what someone would have paid for the item the day before it was destroyed by a home disaster. If someone would have only paid $200 for your five-year-old TV, then the actual cash value is only $200.

ACV is potentially negotiable in personal property claims. However, modern policies frequently work on an RCV basis. RCV policies are usually a little more expensive since they generally don’t require the policyholder to pay as much out of pocket to restore their home to normal.

How Does the Process Work?

You will probably need to pay for replacements and then send the receipts to the insurance company to prove you bought the item. Then they’ll write you a check for the replacement cost.

Insurance companies won’t go out of their way to make sure you get compensated for all the money you invest into replacing personal property damaged by a hurricane – you’ll need to put in the legwork and be persistent to ensure they pay what you’re owed.

Don’t Be Afraid to Exceed Your Replacement Value Policy Limit with Your Inventory

You may want to go up to double over your replacement value policy limit when you’re putting together your inventory list. If you rent and your renters policy has a $10,000 limit on personal property coverage, it’s good if you end up having $15,000 or $20,000 of property documented. The insurance company will likely depreciate the value of all the items on your list by half or more.